when will capital gains tax increase uk

Starting in 2022 the maximum will be raised to 16000. Or could the tax rate be retroactively applied to the 202122 tax year.

Chancellor Eyes Raising Uk Capital Gains Tax To 40 Bambridge Accountants

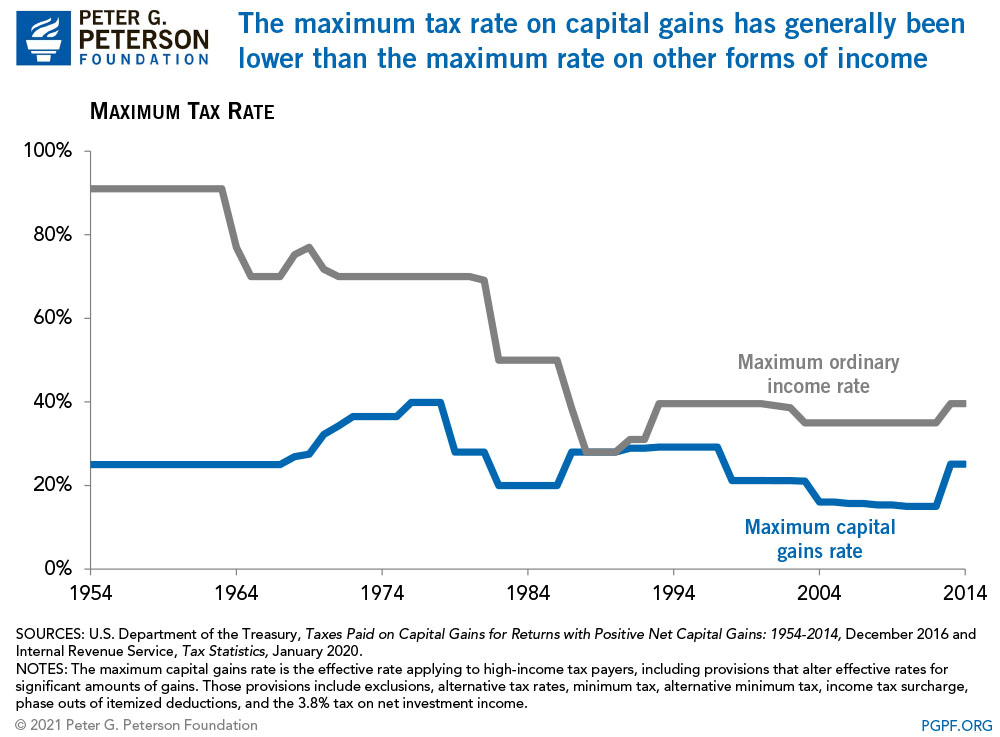

CGT rates differ from income tax rates and are in two broad brackets.

. Technical Specialist - Capital Gains Tax. Jacob Rees-Mogg leads backlash against plan to increase capital gains tax By Simon Foy 4 Nov 2022 757pm Advertisers boycott Twitter as Elon Musk accuses campaign groups. The newspaper also suggested the Chancellor is looking at increasing dividend taxes and halving or even slashing altogether the 2000 tax-free dividend allowance.

Currently there are four rates of CGT being 18 and 28 on UK. Capital gains tax reporting extended Another announcement in the Autumn Budget 2021 affects anyone who makes a capital gain after selling a property. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10.

This week theres been a lot of talk about UK Capital Gains Tax CGT being increasedA report from the Office for Tax Simplification OTS commissioned by chancellor. The two biggest tax-cutting Conservative Chancellors in British history both increased capital gains tax - and for good reasons. Mr Hunt is reportedly considering an.

Jeremy Hunt is set to launch a capital gains tax CGT raid as the Chancellor looks to plug a 50 billion black hole in the public finances. In the 2020 to 2021 tax year individuals with gains under 50000 and taxable income below 37500 contributed 4 of the total gains and represented 37 of those liable to Capital Gains. Rumours are circulating that Hunt is looking at tinkering with Capital Gains Tax including the possibility of changing the reliefs and allowances on the tax or increasing the tax.

Britains government is considering cutting the tax-free allowance for dividend income Bloomberg reported on Thursday before a Nov. This measure reduces the 18 rate of CGT to 10 and the 28 rate of CGT to 20 for chargeable gains except in relation to chargeable gains accruing on the disposal of residential property. The Treasury is mulling increases to Capital Gains Tax and Dividend Tax as Jeremy Hunt seeks to make fair changes to fill a 50billion gap in the UKs finances.

The average CGT bill is already 32000 and the tax rate could. Whilst we dont yet know exactly what the future holds for UK tax most experts agree that tax rises are on the way. Basic rate payers and higheradditional rate payers.

If you sold a UK residential property on or after 6 April 2020 and you have tax on. You also do not have to pay Capital Gains Tax if all your gains in a year are under your tax-free allowance. This means youll pay 30 in Capital Gains.

Thats about 15 of all UK tax receipts. CAPITAL GAINS TAX is Chancellor Rishi Sunaks top tax target in his upcoming Autumn Budget experts warn. Simply put capital gains tax CGT is paid when an asset other than your main residence is sold at a profit.

There is currently a. Peter Webb our Head of Tax Advisory explains when and what Capital. Nimesh Shah of Blick Rothenberg told Expresscouk that it will not be aligned with income tax but the rate will be increased from 2023.

The capital gains tax-free allowance for the 2021-22 tax year is 12300. Aligning capital gains tax with. Over the 20202021 tax year the basic rate on.

Rates of capital gains tax range from 10 to 28 depending on the income of the taxpayer and the type of asset sold. The gains that you make from the selling of your capital assets which you held for at least one year will be considered long-term gains and these can be taxed at anything from 0. The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does.

Jeremy Hunt should follow them and raise.

Jeremy Hunt Considering Plan To Raise Uk Capital Gains Tax To Fill 50bn Black Hole

Capital Gains Tax When Selling A Property Robert Holmes

Crypto Tax Uk Ultimate Guide 2022 Koinly

Will Capital Gains Tax Increase At Budget 2021 What The Property Tax Rate Is And How It Could Change Today

Capital Gains Definition Rules Taxes And Asset Types

Increase Of Capital Gains Tax To Help Pay For Covid 19 Birkett Long Solicitors

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Company Capital Gains Tax Increase In The Uk

Historical Capital Gains Rates Wolters Kluwer

The Definitive Guide To Uk Crypto Taxes 2022 Coinledger

Proposals To Increase Capital Gains Tax In Uk Could Make Guernsey An Even More Attractive Relocation Proposition Swoffers

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

How Much Is Capital Gains Tax Cgt Rates Explained And Budget Proposal Nationalworld

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

2021 Capital Gains Tax Rates In Europe Tax Foundation

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It