is nevada a tax friendly state

Wyoming only imposes approximately 3279 for the same. Nevada relies heavily on revenues from high sales taxes from food to clothing sin taxes on alcohol and gambling and taxes on casinos and hotels.

9 States With No Income Tax Kiplinger

The benefits to an individuals who live in nevada and become a nevada resident will usually escape state taxation of their income except for.

. Nevada has long been a tax-friendly state for both individuals and businesses in the Silver State. However Governor Andy Beshear would. The income tax is highest on our list of the most tax-friendly states but average for.

Is Nevada A Tax Friendly State. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. Money Open Tax Friendly States Tax Income Tax Sales Tax.

Illinois has the highest tax burden in the US with an estimated tax amount of 13894 for the hypothetical family. Is Nevada A Tax Friendly State. New Hampshire however taxes.

The absence of state income tax alone is reason enough to call Nevada home. Its business tax rates range from 4-6. Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Retirement Income.

There are currently nine states without income tax. This will also eliminate state taxation of corporations non-business income if the corporation is organized and domiciled in Nevada. What is exempt from.

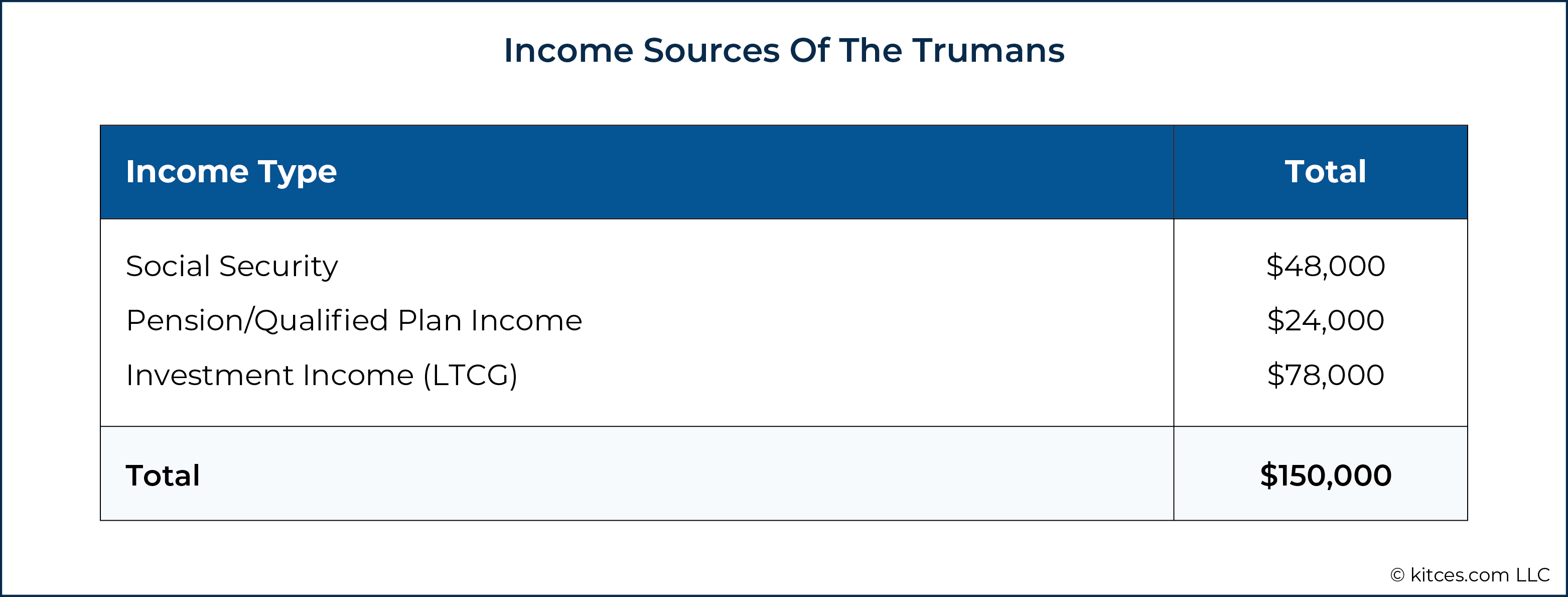

Based on our research these are the 10 US. Average state and local sales tax. This results in a total state-imposed.

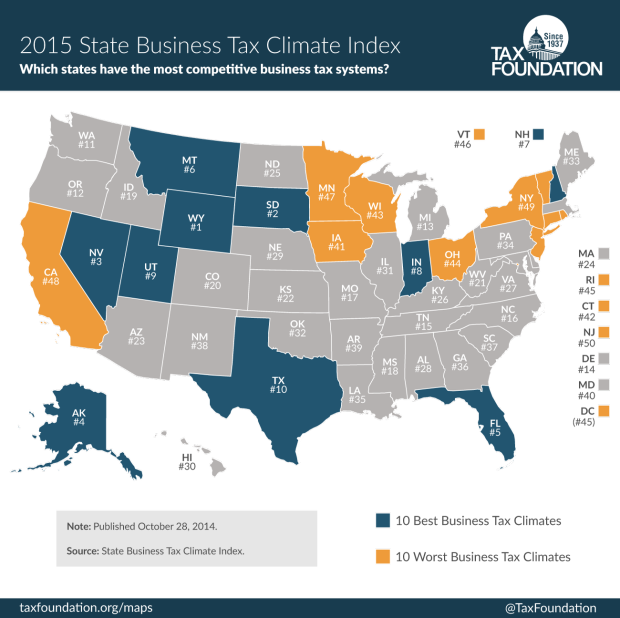

Over the past month this news site has hosted a vigorous debate about why companies are increasingly opting to relocate to the similarly low-tax business-friendly state of Texas instead. Trusts with Nevada fiduciaries can gain a. What is Nevadas sales tax rate 2021.

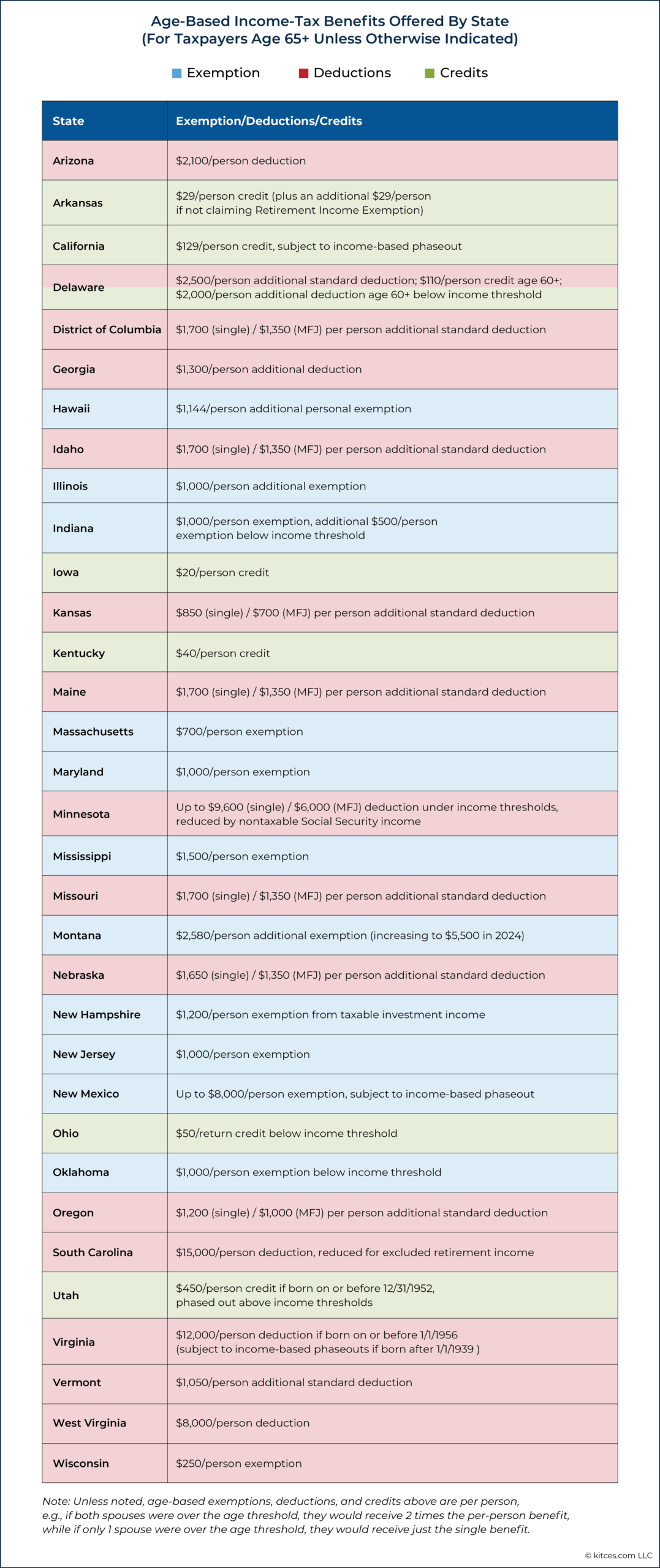

2021 List of Nevada Local Sales Tax Rates. Kentucky has a flat personal income tax rate of 5 which is fairly average among states. States with the lowest tax bills.

24 cents per gallon national average is 32 cents per gallon Grand Tetons WY. Nevada has state sales tax of 46 and allows local governments to collect a local option. Nine states Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming have no income taxes.

The state of the longleaf pine tree Alabama is next on the list with a 745 effective state tax. Total Tax Bill for the Average Family. An analysis by MoneyGeek ranked every state by how tax-friendly it is.

The benefits to an individuals who live in nevada and become a nevada resident will usually escape state taxation of their income except for. The analysts didnt just look at income tax they also factored in property taxes plus state and. What is the most tax-friendly state.

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Gobankingrates

Nevada Graded As One Of The Most Tax Friendly States Saw A 1 5 Population Increase Last Year Nevada Thecentersquare Com

10 Best Places To Retire In Nevada Smartasset

![]()

Tax Friendly States For Retirees Best Places To Pay The Least

Janet Rogers Group Most And Least Tax Friendly States Facebook

The 10 Most Tax Friendly States For Middle Class Families Kiplinger

15 States That Tax Your Income The Least The Motley Fool

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

Corporate Tax Rates By State Where To Start A Business

Arizona Vs Nevada Which State Is More Retirement Friendly

Report Ranks Montana 6th In Nation For Business Tax Climate

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The 10 Most Tax Friendly States For Middle Class Families Kiplinger

2022 Best States To Retire In For Tax Purposes Sofi

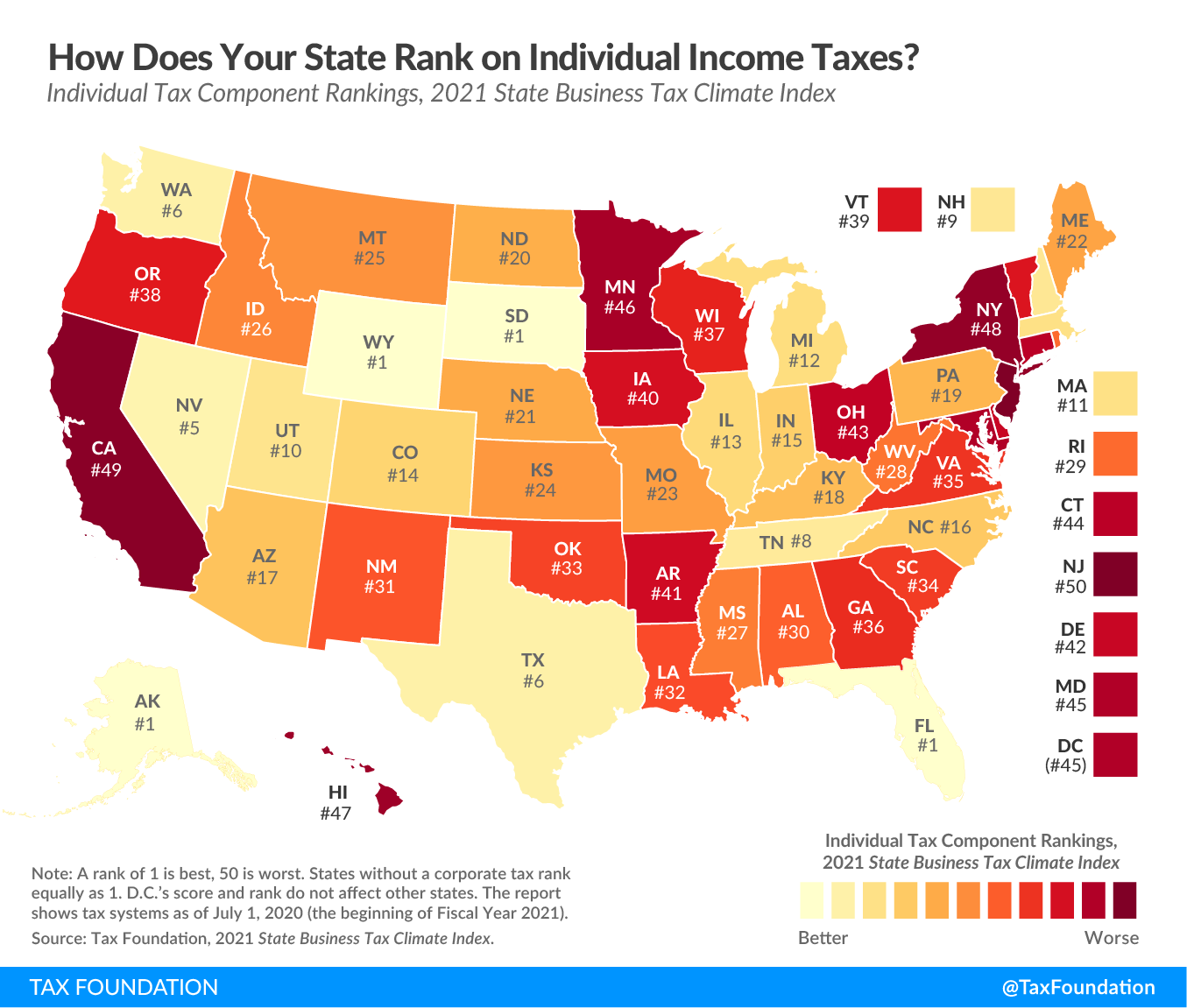

Best Worst State Income Tax Codes Tax Foundation